Assuming purchase costs are rising in a periodic inventory system, businesses face a unique set of challenges and opportunities. Understanding the impact on inventory valuation, inventory costing methods, and inventory level management is crucial for effective decision-making and financial reporting.

This comprehensive analysis explores the intricacies of inventory management in the face of rising purchase costs, providing insights into strategies for optimizing inventory levels, maintaining cash flow, and navigating supplier relationships.

Impact on Inventory Valuation: Assuming Purchase Costs Are Rising In A Periodic Inventory System

Rising purchase costs have a significant impact on the value of inventory in a periodic inventory system. As the cost of goods purchased increases, the value of the inventory held by the business also increases.

This has implications for financial reporting and decision-making. For example, if a business has a large amount of inventory on hand when purchase costs rise, the value of that inventory will be higher than if the business had purchased the goods at a lower cost.

Inventory Costing Methods

The choice of inventory costing method can also affect how rising purchase costs impact the value of inventory.

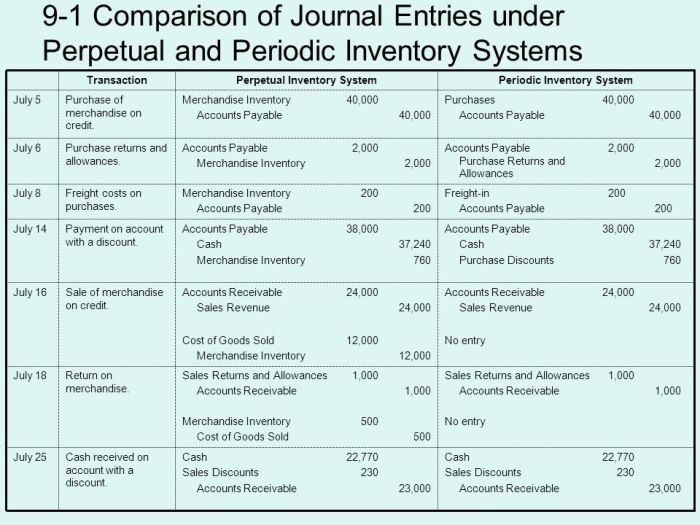

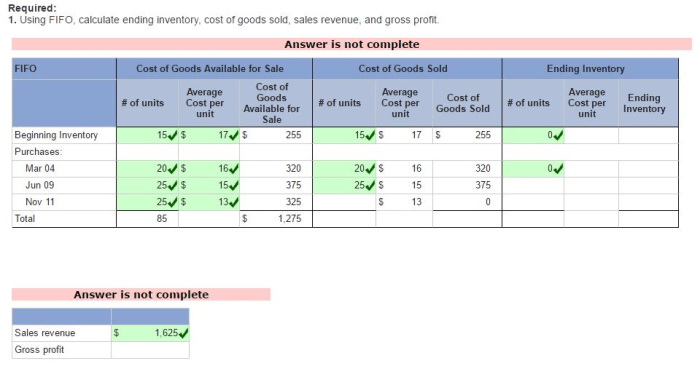

- FIFO (First-In, First-Out):Under FIFO, the oldest inventory is sold first. This means that the cost of goods sold will be based on the cost of the oldest inventory on hand, which may be lower than the current purchase cost.

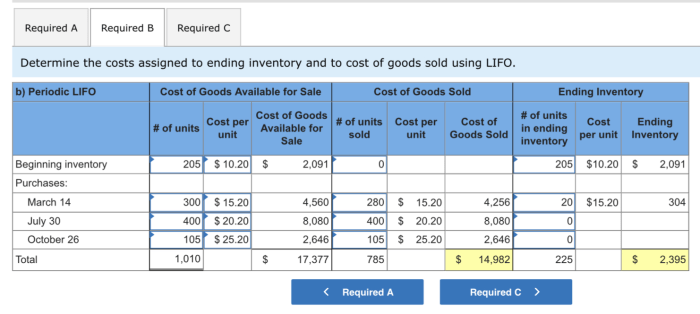

- LIFO (Last-In, First-Out):Under LIFO, the most recently purchased inventory is sold first. This means that the cost of goods sold will be based on the cost of the most recent purchases, which may be higher than the cost of the oldest inventory on hand.

- Weighted Average:Under the weighted average method, the cost of goods sold is based on the average cost of all inventory on hand. This method is less sensitive to changes in purchase costs than FIFO or LIFO.

Management of Inventory Levels

Businesses can employ a number of strategies to manage inventory levels in response to rising purchase costs.

- Reduce inventory levels:One way to reduce the impact of rising purchase costs is to reduce inventory levels. This can be done by increasing inventory turnover or by reducing the amount of safety stock held.

- Increase inventory levels:In some cases, it may be necessary to increase inventory levels to avoid stockouts. This can be done by increasing the amount of safety stock held or by purchasing more inventory in advance.

Impact on Cash Flow

Rising purchase costs can have a significant impact on a business’s cash flow.

When purchase costs rise, the business will need to pay more for the same amount of inventory. This can put a strain on the business’s cash flow, especially if the business does not have sufficient working capital.

Pricing Strategies, Assuming purchase costs are rising in a periodic inventory system

Rising purchase costs can also affect a business’s pricing strategies.

If a business’s purchase costs rise, it may need to increase its prices to maintain its profit margins. However, this may lead to a decrease in sales if customers are not willing to pay the higher prices.

Supplier Relationships

Rising purchase costs can also affect a business’s relationships with suppliers.

If a business’s purchase costs rise, it may need to negotiate with its suppliers to get a better price. This can be a difficult process, and it may damage the relationship between the business and its suppliers.

FAQs

What are the implications of rising purchase costs for inventory valuation in a periodic inventory system?

Rising purchase costs increase the value of ending inventory, potentially leading to higher cost of goods sold and lower net income.

How do different inventory costing methods affect inventory valuation when purchase costs are rising?

FIFO results in higher cost of goods sold and lower ending inventory value, while LIFO results in lower cost of goods sold and higher ending inventory value.

What strategies can businesses employ to manage inventory levels in response to rising purchase costs?

Businesses can reduce inventory levels to minimize the impact of rising purchase costs or increase inventory levels to hedge against future price increases.